In 2022, there were 149,077 Chapter 13 filings, a 26.6 percent rise from 117,784 the year before. Making a massive decision like filing for bankruptcy can have a long-lasting negative impact on your money and credit. Additionally, because it is a complex legal procedure, you may need to conduct some study before deciding on your course of action and whether it is indeed the right choice.

Choosing between Chapter 7 bankruptcy and Chapter 13 bankruptcy will be one of your first major decisions if you decide to file. These chapter names correspond to portions of the U.S. Bankruptcy Code that specify how each bankruptcy procedure will address your debt.

The decision to file either of the two affects whether you will be placed on a debt repayment schedule or if your obligations will be paid with the property you own. Start here to get a sense of what lies ahead if you are stuck in the path. But you may get your finances in order by contacting our knowledgeable bankruptcy attorney at Attorney Debt Fighters. For a new beginning in money management, schedule a free consultation with our team of experienced attorneys.

What Is Bankruptcy?

The legal process of declaring bankruptcy lessens or removes the requirement to repay some debts and provides a fresh start for individuals or organizations.

Due to the possibility of applying various chapters of bankruptcy legislation based on the debtor’s status as an individual or a company and other variables, bankruptcy can be complex.

Chapters 7, 9, 11-13, and 15 are the six different types of bankruptcy. Consumers have the choice between Chapter 7 bankruptcy and Chapter 13 bankruptcy.

What are Bankruptcy Basics?

There are six different types of bankruptcies, each titled after a chapter of the Bankruptcy Code that governs all bankruptcies in the United States. They all can shield overextended borrowers from creditors, enabling them to put off paying back some or all of their debts. The difference between each bankruptcy kind is that each has a unique procedure and is meant for specific debtors.

Chapter 7 or Chapter 13 bankruptcy filings are the most common since they cater to individual debtors. Chapter 11 may be acceptable for sole owners and other business individuals, despite businesses also using it.

Municipalities may enter Chapter 9 bankruptcy to restructure debt, while Chapter 12 bankruptcy is for family farmers and fishers. When parties from multiple nations file for bankruptcy, Chapter 15 is employed.

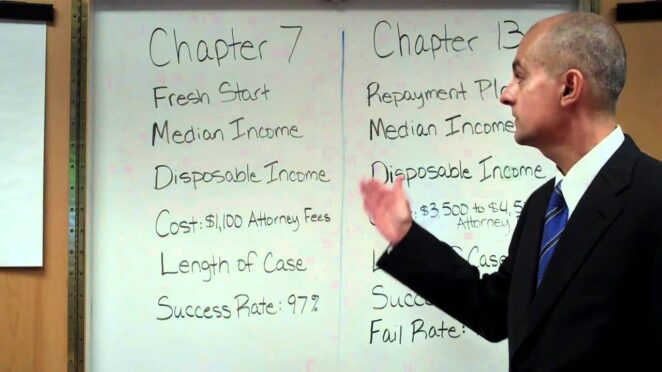

What Makes Chapter 13 Different from Chapter 7 Bankruptcy?

Chapters 7 and 13 are different approaches to giving a person in debt choices to get debt relief. The option you can take advantage of will depend on your financial situation.

When filing for bankruptcy, Chapter 7 is commonly referred to as “straight bankruptcy” and Chapter 13 as “wage bankruptcy.” However, neither choice prevents you from paying alimony, child support, or several types of taxes.

Since Chapter 7 bankruptcy entails selling assets to pay creditors, sometimes referred to as a liquidation. A trustee is responsible for managing the debtor’s eligible property.

Some assets, including personal belongings and even real estate, may not be subject to liquidation based on federal exemption rules and the state where you reside. According to the United States Courts, a debtor can decide whether to use the exemptions provided by federal law or those mandated by their state’s legal system.

Following the distribution of non-exempt assets to creditors, the remaining eligible debt is dismissed, which means the debtor does not have to repay it. Creditors cannot seek legal action to collect debts after the courts have legally rejected them.

But some debts are not dischargeable. The majority of taxes, court fees, student loans, alimony, child support, and debts accrued from impaired driving are among them.

Chapter 13 deals with restructuring and remittance. You must have a consistent source of income to be eligible. Individual debtors will follow a 3- to 5-payment plan to creditors.

In most circumstances, Chapter 13 allows you to retain your property. According to the U.S. Courts, people can utilize a Chapter 13 proceeding to prevent their houses from going into foreclosure.

As a neutral middleman, the trustee’s job in a Chapter 13 case is to accept payments from the debtor and distribute them to the creditors. All remaining bills, including credit card debt, are forgiven.

What Constitutes a Bankruptcy’s Eligibility?

Your income determines your eligibility the most. To file for Chapter 7, you must either have a salary that is lower than the state median or be able to prove that you have enough disposable income to settle your debts. You must consider Chapter 13 bankruptcy if you don’t meet the requirements for Chapter 7.

You would be eligible for this approach if you had a steady income, secured obligations of $1,257,850, and unsecured debts under $419,275. (as of 2021).

What are the Pros and Cons of Chapter 7 or Chapter 13 Bankruptcy?

Following are the pros and cons of Chapter 7 or Chapter 13 bankruptcy.

Pros of Chapter 7 or Chapter 13 Bankruptcy

On a lot of your debts, you can start over. Taxes and student loans are difficult to exclude from your ledger in bankruptcy. Bankruptcy won’t erase any child support obligations you may have. There will be a permanent discharge of many debts, including medical bills and credit card debt.

Cons of Chapter 7 or Chapter 13 Bankruptcy

Expect to see a reduction in your credit score. If you’re going bankrupt, there’s a good chance that your credit wasn’t in the finest position. According to anecdotal evidence, some lenders have lent to borrowers after a bankruptcy. Why? Because the lender is aware that you are no longer in severe debt and are probably capable of making regular payments.

Which Chapter Is Right for You?

Chapter 7 is typically the best option for filers with little income and mainly unsecured obligations, such as personal loans and credit cards.

For someone who files for bankruptcy and has a consistent, steady income and the ability to pay back the debt over time, Chapter 13 is probably the best option.

The Bottom Line

Declaring bankruptcy can be frightening, yet it may be the only way to reorganize your finances and go on without having your debt become ever more significant to the point where a collection firm like Darrell Cook & Associates will come after you. Whatever the case, seek expert guidance, educate yourself on your rights, and remember that there is always hope.

You may get your finances in order by contacting our knowledgeable bankruptcy attorney. In addition, you can locate negotiation, debt consolidation, a bankruptcy lawyer, and other legal professionals to obtain the rights you deserve.