Although ethical investing offers investors ways to make money and provide for the world, not every investor pursues ethical investing or focuses on sustainability. Nevertheless, making ethical investments results in profitable gains for investors and better outcomes for humanity and the world. No companies contribute zero negative impact, but ethical investors can increase their earnings over time and give back to the world with conscious planning and decision-making.

Every individual is entitled to their opinions, values, and beliefs. We have free will to make the choices we choose to make. However, despite these freedoms, we are not immune to the consequences of contributing harm to others. Ethical investors understand the importance of following the golden rule with their investment decisions to bring the least harm to society.

You don’t need to seek perfection to make ethical investments, but you do need to consider the basic principles that surround the intent to do no harm. Considering the components of sustainability when you look to invest can give you a head start. Here is more information on why you should invest in ETFs that are sustainable.

What Is An ETF?

ETF is shorthand for exchange-traded funds. The purpose of an exchange-traded fund (ETF) is to serve as an ethical investment. Ethical investments aim to contribute the most benefit and the least amount of harm to society.

ETFs That Are Sustainable

ETFs that are sustainable are often the route ethical investors take for their investments, as they may also contribute the greatest amount of good and the least amount of harm to society. Investing in ETFs that are sustainable is a wise choice as they allow investors to make money, contribute positively to society, the environment, and the world, and potentially offset the harmful activities of companies that are doing more harm than good. Likewise, ETFs can be specific to the cause you’re passionate about.

Why Invest In An ETF?

The main reason to invest in an ETF is to provide value to the investor, the companies involved, and to society. One kind of ETF that serves these purposes is the Benefit Corporation ETF. Under this fund, the objective is to help investors earn money and contribute positively to the public. This way, all parties (employees, customers, and the public) achieve the most value possible under the investment. Ethical investors often align with the goals of the Benefit Corporation ETFs, given the great emphasis on contributing significant public benefit.

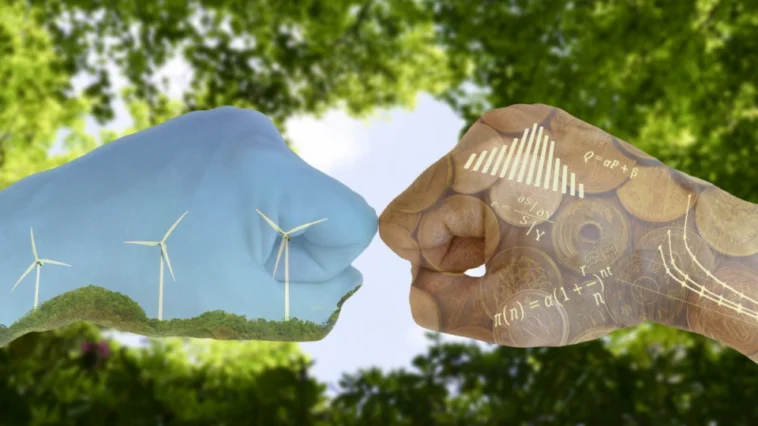

Sustainability Is More About Profit Than You Think

Even though sustainability is associated with reducing a negative impact, it is also a way for investors to safeguard their investments for longer, allowing them to make more.

Think about it: if an investor pursues ETFs that are sustainable, what does that mean?

- It means that the investment will last for a greater amount of time before it has the potential to either fall away or no longer benefit society.

- For ethical investors, it is intriguing to understand that by choosing ETFs that are sustainable, they can help the environment and society while also earning more money for a longer period.

- Not only does this increase earnings potential, but it produces a greater likelihood and lifespan of positive human impact.

Consequences Of Standard Investments

Alternatively, an investor would invest in a company that produces cheap products to save on the initial investment and ultimately earn more via fast company production. Even if the investor can earn more, their investment in cheap materials and fast production reduces its sustainability. It will likely cause more harm than benefit and, ultimately, reduce the earning potential of the investor.

Still, there are exceptions to this rule. Tobacco corporations are still around despite their negative impact on society; however, the costs are dire. Ethical investing is rooted in valuing humanity and disregards companies that contribute damage to people and the world.

To Penalize Bad Businesses

For some investors, the goal is not only to make money and promote societal good but to rule out the bad. Unfortunately, many bad businesses wreak havoc on society, the environment, and the world. Some companies are solely interested in making money, regardless of consequences as serious as air pollution, global warming, and the loss of human life. It would seem that no one is stepping in to stop the chaos without regard for the consequences, but ethical investors are, in some ways, real-life superheroes.

ETFs that are sustainable may hold some ability to penalize bad businesses for negatively contributing to the world, such as via financial consequences. They may also have the agenda of penalizing companies that significantly cause harm to society and the environment. Ethical investors may choose to pursue ETFs that are sustainable only after they have already noted the options that are entirely off the table. Ethical investors can also note in their portfolios which funds and companies to avoid or to speak with to encourage sustainable improvements.

ETFs Can Support Specific Causes

If you are an ethical investor looking to support specific public causes or create positive human impact, you can find ETFs that are sustainable for particular causes. Many ETFs are focused on specific things, which means that you might find your perfect investment opportunity by going with this approach. The caution, however, is to ensure that you are not ignoring other sustainability factors by focusing on just one element.

For instance, if you want to support local businesses, make sure that in doing so, you are not overlooking company culture and worker treatment. Some ETFs that are sustainable focus on specific sustainability factors; these are referred to as “single-theme funds.” If you’re interested in this approach, reach out to a firm that understands quantification so you can determine whether your investment decision is as ethical as it appears.

Plan For A Better Tomorrow

ETFs that are sustainable are solid investment choices if your goals are to profit but also to recognize the impact of such investments. Look into sustainable ETFs and work on your plan for a better tomorrow.